Q1:2026 Freight Index Forecast

You’ve long used data for forecasting, budgeting and other strategic initiatives. But the volume of data is skyrocketing and one of the great modern business challenges is knowing what data matters and what to dismiss.

Each quarter, AFS collaborates with TD Cowen, a leading full-service investment bank, to bring you current, highly relevant data and insights that matter to your business.

Freight index forecast key takeaways for Q1:2026

-

The Freight Index shows only tentative signs of recovery in the truckload freight market, as supply-side pressures and seasonality push moderate rate growth amid flat demand.

-

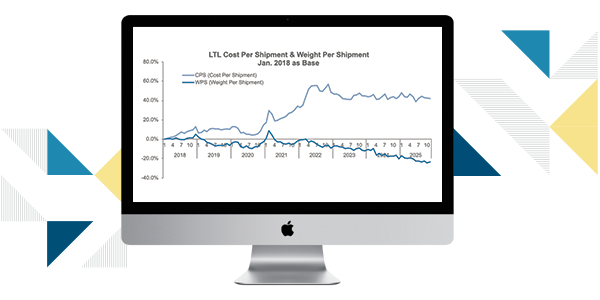

Data shows record-high LTL rates in Q4 2025 and projects a ninth straight quarter of YoY growth in Q1, a testament to continued carrier pricing strength in a segment with continued soft demand.

-

AFS projects ground parcel rates to reach a record high in Q1 on the heels of a record-setting Q4 2025, driven by the combined effects of seasonal trends and carrier pricing actions.

Download the Full Q1:2026 TD Cowen/AFS Freight Index

What is the freight index?

The TD Cowen/AFS Freight Index offers a unique and comprehensive view of both past market performance and rate forecasts for the immediate future quarter, for full truckload shipping, less-than-truckload shipping and parcel shipping, both express and ground.

Massive client historical data and current macro and microeconomic factors are carefully evaluated and selected, with their impact built into our predictive models.